Updated in May 2025.

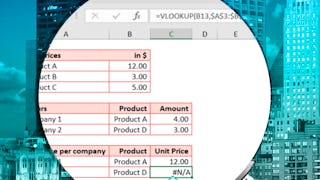

This course now features Coursera Coach! A smarter way to learn with interactive, real-time conversations that help you test your knowledge, challenge assumptions, and deepen your understanding as you progress through the course. This course takes a deep dive into the world of project finance, where you will learn to build financial models from the ground up using Excel. Whether you're new to finance or looking to sharpen your modeling skills, this course introduces key concepts in project finance, such as understanding eligible transactions and building input assumption sheets. Using a real-world case study, the course will guide you step by step through the intricacies of financial modeling, including multi-scenario input sheets and timeline assumptions. In the second phase, you'll explore more advanced topics such as the construction phase and debt sizing, which are essential for forecasting costs and revenue accurately. The course provides hands-on experience with building detailed financial statements like the Profit & Loss statement, Cash Flow Waterfall, and Balance Sheet. Throughout, you'll develop a comprehensive understanding of how to construct models that are both dynamic and adaptable to real-world projects. Finally, you will wrap up by calculating return metrics like the Internal Rate of Return (IRR), which is crucial for assessing project viability. By the end of the course, you’ll be fully equipped to handle every stage of a project’s financial modeling lifecycle, from initial assumptions to detailed cash flow forecasts and financial statement analysis. This course is designed for finance professionals, analysts, and anyone looking to specialize in project finance. A basic understanding of Excel is recommended, though no prior finance experience is necessary. Those with an interest in infrastructure, energy, and large-scale project financing will benefit from the practical skills covered.