While investing and trading in the options market may seem somewhat more daunting than other asset classes such as stocks, bonds, exchange-traded funds, currencies and commodities, you’ll ultimately find that their complexity can be boiled down to simple concepts you’ll be able to understand and use the more you’re exposed to, and have hands-on experience with the material. Our aim is for you to acquire these skills, as well as the know-how, to invest and trade in these often-complex financial instruments.

Give your career the gift of Coursera Plus with $160 off, billed annually. Save today.

Derivatives - Options & Futures

This course is part of Practical Guide to Trading Specialization

Instructors: Jeff Praissman

30,693 already enrolled

Included with

(208 reviews)

Recommended experience

What you'll learn

Language of stock options, understanding of the roles and responsibilities of buyers and sellers. The mechanics of trading in the futures markets.

Learn how to deconstruct options, distinguish between call and puts and the roles of contract writers and owners

Examine multiple stock option payoff charts and determine breakevens and maximum profit and loss

Skills you'll gain

Details to know

Add to your LinkedIn profile

34 assignments

See how employees at top companies are mastering in-demand skills

Build your subject-matter expertise

- Learn new concepts from industry experts

- Gain a foundational understanding of a subject or tool

- Develop job-relevant skills with hands-on projects

- Earn a shareable career certificate

Earn a career certificate

Add this credential to your LinkedIn profile, resume, or CV

Share it on social media and in your performance review

There are 5 modules in this course

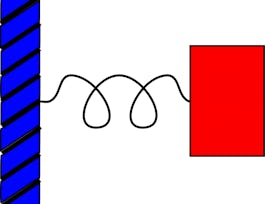

Overview of options, which includes: Distinguishing between call and put options; Identifying the components of an options contract on a trading platform; Making certain decisions in the options market as a contract writer or owner; Viewing different stock options positions; Examining whether a given position is in- or out-of-the-money and Understanding some of the benefits and critical risks faced by equity options traders. Options involve risk and are not suitable for all investors. For more information read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD). To receive a copy of the ODD call 312-542-6901 or copy and paste this link into your browser: http://www.optionsclearing.com/about/publications/character-risks.jsp.

What's included

5 videos1 reading6 assignments

Learn about the Options Market Mechanics by introducing topics such as put-call parity, pricing, payout of an option trade, and certain risk variables referred to as "The Greeks". Options involve risk and are not suitable for all investors. For more information read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD). To receive a copy of the ODD call 312-542-6901 or copy and paste this link into your browser: http://www.optionsclearing.com/about/publications/character-risks.jsp. Multiple leg strategies, including spreads, will incur multiple commission charges.

What's included

4 videos3 readings4 assignments

This module will focus on some basic strategies to use in bull markets – when prices rise – and in bear markets – where prices fall. As you may have gathered from earlier lessons, the characteristics of options requires skill and precision when making investment decisions. These strategies are displayed to give you an idea of what might work when making investing decisions. In this module, we’ll offer an explanation of several strategies for either type of market outlook, and we’ll also walk you through what they are designed to achieve. We’ll further provide a practical demonstration of how to set up each trade using IBKR’s Trader Workstation. Options involve risk and are not suitable for all investors. For more information read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD). To receive a copy of the ODD call 312-542-6901 or copy and paste this link into your browser: http://www.optionsclearing.com/about/publications/character-risks.jsp.

What's included

11 videos6 readings11 assignments

In the previous module we introduced you to several trades designed to be of use in either up or down markets. In this module, we’ll explore a couple of strategies that may be used by option traders to take advantage of a lull in the markets.

What's included

5 videos3 readings5 assignments

Introducing the Mechanics of Futures Market course, where we’ll introduce you to some of the risks faced by investors in the futures market, how certain of those risks are mitigated, as well as the difference between spot and forward prices, and contango and backwardation. We’ll also provide you with other insights about the mechanics of trading futures, including the roles of commoditized contracts, as well as margin requirements.

What's included

9 videos3 readings8 assignments

Instructors

Offered by

Recommended if you're interested in Finance

Johns Hopkins University

Coursera Instructor Network

The Hong Kong University of Science and Technology

Why people choose Coursera for their career

Learner reviews

Showing 3 of 208

208 reviews

- 5 stars

67.94%

- 4 stars

20.57%

- 3 stars

7.17%

- 2 stars

2.39%

- 1 star

1.91%

New to Finance? Start here.

Open new doors with Coursera Plus

Unlimited access to 7,000+ world-class courses, hands-on projects, and job-ready certificate programs - all included in your subscription

Advance your career with an online degree

Earn a degree from world-class universities - 100% online

Join over 3,400 global companies that choose Coursera for Business

Upskill your employees to excel in the digital economy

Frequently asked questions

Access to lectures and assignments depends on your type of enrollment. If you take a course in audit mode, you will be able to see most course materials for free. To access graded assignments and to earn a Certificate, you will need to purchase the Certificate experience, during or after your audit. If you don't see the audit option:

The course may not offer an audit option. You can try a Free Trial instead, or apply for Financial Aid.

The course may offer 'Full Course, No Certificate' instead. This option lets you see all course materials, submit required assessments, and get a final grade. This also means that you will not be able to purchase a Certificate experience.

When you enroll in the course, you get access to all of the courses in the Specialization, and you earn a certificate when you complete the work. Your electronic Certificate will be added to your Accomplishments page - from there, you can print your Certificate or add it to your LinkedIn profile. If you only want to read and view the course content, you can audit the course for free.

If you subscribed, you get a 7-day free trial during which you can cancel at no penalty. After that, we don’t give refunds, but you can cancel your subscription at any time. See our full refund policy.