- Risk Management

- Corporate Tax

- Microsoft Excel

- Depreciation

- Capital Budgeting

- Risk Analysis

- Portfolio Management

- Project Finance

- Project Risk Management

- Cash Flows

- Project Portfolio Management

- Spreadsheet Software

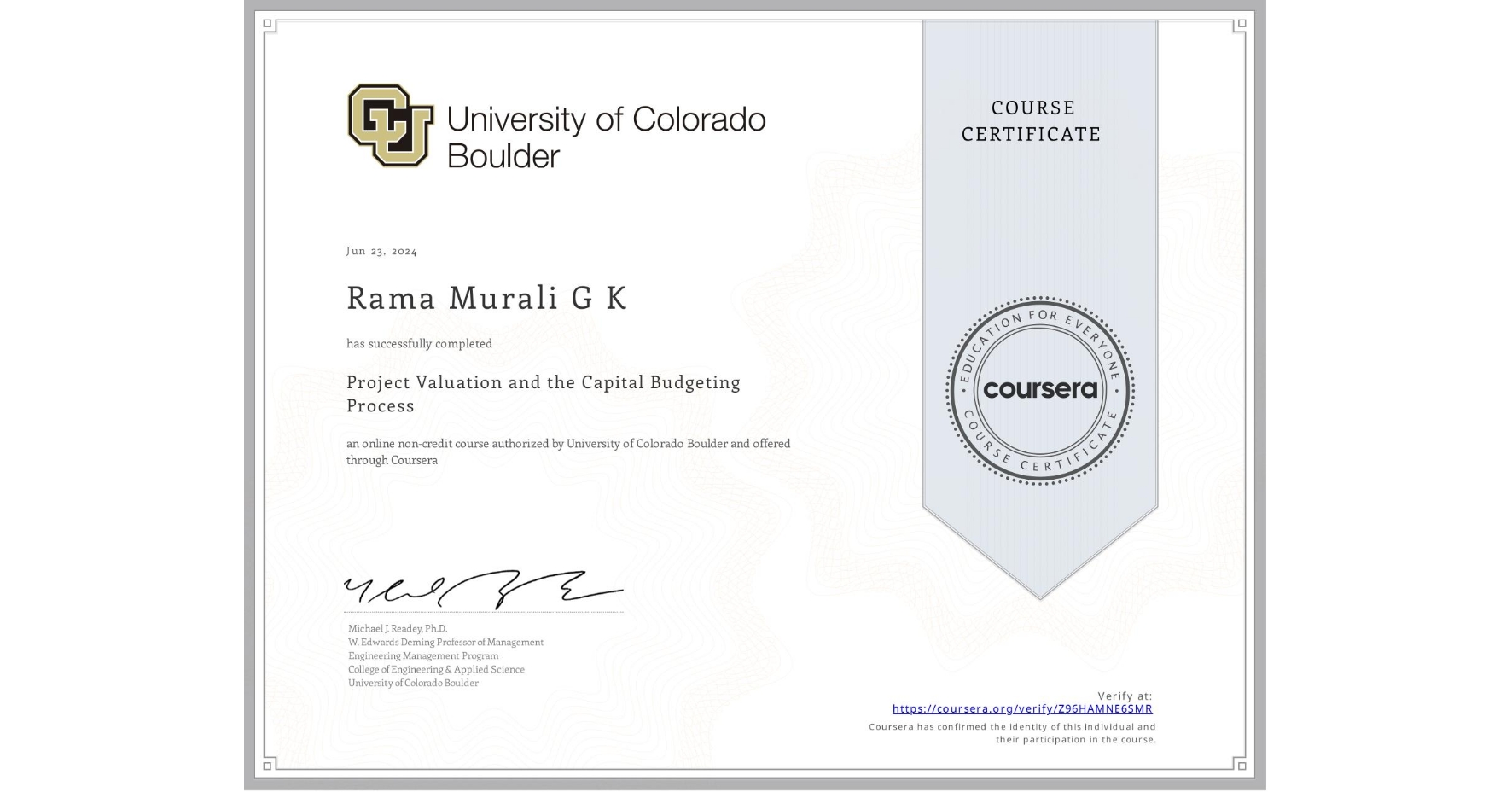

Project Valuation and the Capital Budgeting Process

Completed by Rama Murali G K

June 23, 2024

17 hours (approximately)

Rama Murali G K's account is verified. Coursera certifies their successful completion of Project Valuation and the Capital Budgeting Process

What you will learn

Determine the net present value (NPV), internal rate of return (IRR), and payback periods (PBP) of a series of cash flows using spreadsheet analysis

Apply NPV, IRR, and PBP criteria to evaluate an organization’s investment options

Understand depreciation of capital assets, income taxes, and the effects of inflation and foreign exchange on cash flow

Build a sophisticated financial model by incorporating realistic cash flows for a project

Skills you will gain