Economics

economics, economic policy, international economics, and economic development....

Earn Your Degree

Most Popular Courses

Learning paths for 40+ in-demand careers

Advance in your career with recognized credentials across levels.

Achieve your career goals

Subscribe to earn unlimited certificates and build job-ready skills from top organizations.

Top Rated Courses

Beginner Economics Courses

Most Popular Certificates

Finish an Economics Course in Under 24 Hours

More Economics Courses

Frequently Asked Questions about Economics

Because we hear about "the economy" in the news so often, many people have the misconception that economics is simply the study of business or making money. While this can be close to the truth in some cases, economics more broadly is a study of making decisions under conditions of scarcity, whether in terms of limited time, money, or other resources. Economics encompasses everything from the microeconomics of a personal decision about grocery shopping to the macroeconomics concepts used to describe the aggregated decision-making of entire populations.

Indeed, economics has many useful concepts that we can use to better understand how we approach various decisions in our daily lives, regardless of whether money is involved. The concept of "opportunity cost" describes the lost gains from one alternative that we sacrifice when we choose another; for example, if you decide to major in economics, one opportunity cost is losing the ability to major in engineering instead.

Of course, the ability of economics to explain and predict decision-making is particularly powerful in the realm of business. The concept of "competitive advantage," for example, guides companies to focus their business on products and services that they can provide either at a lower cost or with a higher value than their competitors. This is still a core concept for entrepreneurs, who must clearly define their competitive advantage as well as their strategy for preserving it to raise funding from venture capital or other investors.

The myriad applications of economic thought have led to the creation of many more specific subfields, such as project economics, behavioral economics, environmental economics, and others. But at the end of the day, they are all united by a focus on decision-making with constraints - regardless of what the limited resources are.

A background in economics can be a gateway to a number of interesting -- and often, high-paying -- careers. The ability to analyze the factors driving economic decision-making is a hugely valuable skill, whether employed in the public or private sector.

Banks, hedge funds, institutional investors, and a wide range of other financial institutions employ economists in roles such as financial analysts, investment analysts, and pricing analysts to help evaluate the risks and potential returns of investments. Government researchers in economics do similar work, helping to arm policymakers with the information they need about trends in the national as well as global economy.

Some students of economics prefer more detail-oriented career paths. For example, accountants use their expertise in allocating the revenues and expenses of different business activities over time to help companies make critical resource allocation decisions. And in the world of insurance, an actuary is responsible for quantifying risk -- an indispensable role in helping businesses manage uncertainty.

Regardless of whether you prefer to contemplate big picture questions of the global economy or more specialized questions about how to classify and attribute different business costs, careers in economics require the ability to combine quantitative analysis and qualitative evaluations.

Coursera offers a wealth of opportunities to develop your skills in the field of economics, regardless of your level of expertise and your area of focus.

If you're just beginning your economics studies and want to get a perspective on what this discipline has to offer, you may want to start with introductions to macroeconomics, microeconomics, or international trade and globalization. On the other hand, if you already have familiarity with the basics and want to dive deeper into this field, you can take courses in more specialized subjects like corporate finance, risk management, behavioral economics, or game theory.

No matter what your goals are for your education and career, taking online courses, Specializations, and Guided Projects in economics through Coursera offers distinct advantages. You can get an education from high-quality institutions like Columbia University, the University of Illinois at Urbana-Champaign, and the University of California, Irvine, at a significantly lower cost than on-campus students. The ability to take courses online also allows you to fit learning into your existing schedule, giving you the flexibility to build your skills while continuing to work at your current job or raising a family.

Economics courses on Coursera offer a range of concepts and analytical tools for understanding economic dynamics:

- Fundamental principles of microeconomics and macroeconomics.

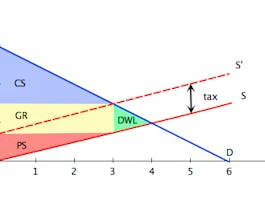

- Analytical techniques for evaluating economic policies and their impacts on markets and societies.

- Understanding of global economic systems and the factors that influence economic growth.

- Skills in using statistical and econometric methods to analyze economic data.

- Knowledge of behavioral economics and its application to consumer decision-making.

- Economic modeling and forecasting to predict trends and inform strategic decisions.

- Insights into development economics, including strategies for addressing poverty and inequality.

Economics courses on Coursera are designed to meet learners at various stages of their education and career:

- Introductory courses are suitable for learners new to economics, offering a broad overview of essential economic theories and concepts.

- Intermediate courses provide deeper exploration into specific economic topics, ideal for learners with some foundational knowledge.

- Advanced courses are available for learners looking to specialize further, focusing on complex economic theories and quantitative analysis.

Coursera provides various educational opportunities in economics:

- Professional certificates that can help you demonstrate your understanding and skills in economics.

- Specialized course certificates that focus on particular areas within economics, such as environmental economics or financial economics.

- Degree programs and professional qualifications that can deepen your expertise and prepare you for advanced roles in economic analysis or policy-making.

These options are intended to enhance your educational profile and support your career development in the field of economics.

Studying economics on Coursera can prepare you for a range of career opportunities in various sectors:

- Economic Analyst: Analyze economic conditions to guide business strategies and policy decisions.

- Financial Consultant: Provide advice on investments, market trends, and economic planning.

- Policy Advisor: Develop and assess public policies based on economic theories and data.

- Market Research Analyst: Study market conditions to examine potential sales of a product or service.

- Academic Researcher: Conduct research to advance understanding of economic phenomena and influence academic and practical approaches to economics.

Online Economics courses offer a convenient and flexible way to enhance your existing knowledge or learn new Economics skills. With a wide range of Economics classes, you can conveniently learn at your own pace to advance your Economics career.

When looking to enhance your workforce's skills in Economics, it's crucial to select a course that aligns with their current abilities and learning objectives. Our Skills Dashboard is an invaluable tool for identifying skill gaps and choosing the most appropriate course for effective upskilling. For a comprehensive understanding of how our courses can benefit your employees, explore the enterprise solutions we offer. Discover more about our tailored programs at Coursera for Business here.

What Coursera Has to Offer

| Learning program | Description |

|---|---|

Guided Project | Learn a job-relevant skill that you can use today in under 2 hours through an interactive experience guided by a subject matter expert. Access everything you need right in your browser and complete your project confidently with step-by-step instructions. |

Project | Learn a new tool or skill in an interactive, hands-on environment. |

Course | Take courses from the world's best instructors and universities. Courses include recorded auto-graded and peer-reviewed assignments, video lectures, and community discussion forums. When you complete a course, you’ll be eligible to receive a shareable electronic Course Certificate for a small fee. |

Specialization | Enroll in a Specialization to master a specific career skill. You’ll complete a series of rigorous courses, tackle hands-on projects, and earn a Specialization Certificate to share with your professional network and potential employers. |

Professional Certificate | Whether you’re looking to start a new career or change your current one, Professional Certificates on Coursera help you become job ready. Learn at your own pace from top companies and universities, apply your new skills to hands-on projects that showcase your expertise to potential employers, and earn a career credential to kickstart your new career. |

MasterTrack® Certificate | With MasterTrack® Certificates, portions of Master’s programs have been split into online modules, so you can earn a high quality university-issued career credential at a breakthrough price in a flexible, interactive format. Benefit from a deeply engaging learning experience with real-world projects and live, expert instruction. If you are accepted to the full Master's program, your MasterTrack coursework counts towards your degree. |

Degree | Transform your resume with a degree from a top university for a breakthrough price. Our modular degree learning experience gives you the ability to study online anytime and earn credit as you complete your course assignments. You'll receive the same credential as students who attend class on campus. Coursera degrees cost much less than comparable on-campus programs. |